Decentralized KYC (DKYC) in Blockchain – Definitive Guide

Decentralized KYC in blockchain is a new way to verify customers’ identities by using their public keys instead of their personal information. It eliminates the need for a central authority to store data about all of its users, which makes it more secure than other methods like email verification or SMS verification.

The advent of Blockchain technology managed to leverage the KYC process and is here to make it swift and smooth in the form of DKYC.

Note: Here, the full form of DKYC is Decentralized Know Your Customer.

Let us explain to you how Decentralized KYC will revolution customer processes, but first, let’s delve into what KYC is.

What is KYC?

KYC (Know Your Customer) was a visionary approach permitting banks to capture crucial customer details before proffering any financial services and aid. Aimed to strengthen the business-customer relationship.

KYC soon become mandatory compliance for banking bodies. However, it took no time to turn KYC into a bane from boon as the process is resource-intensive, has a higher error probability, and filled with multiple silos.

Decentralized KYC fills the operational gaps of customary KYC efficiently. But, We have a lot more to share about this cutting-edge and ingenious blockchain based KYC approach.

The Caveats of Traditional KYC Process

Though the claims of introducing the KYC process were very promising, it was hard to ignore the challenges that banks across the globe were facing during its implementation.

- There is no standardization of the process. With each bank adopting its customized KYC process, customers faced KYC fatigue by doing it differently for different banks. Hence,They get bored of providing the same information repeatedly.

- The lack of KYC standards for centralized exchanges and solutions made the request compiling process too much time-consuming.

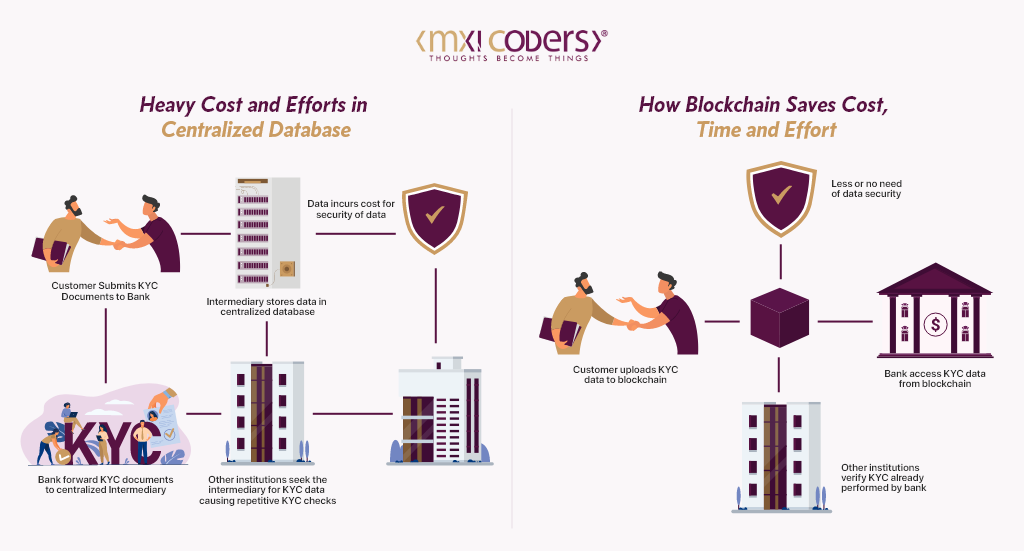

- The process was resource-consuming due to requirement of more workforce. The increased overhead forced banks to raise the customer onboarding cost, transaction fees, and other charges. Thus, this had a negative impact on customer engagement.

- Despite paying utmost attention, the process never remained 100% accurate. Therefore, Auditing and data verification were two added responsibilities handed over to banks.

These challenges were tarnishing the glory of the KYC process and compelled banking service providers to find viable solutions.

What is Decentralized KYC – An Aid Offered By Blockchain Technology

Blockchain technology has already revolutionized multiple aspects of human life. This time, the technology finds its use case in KYC and the outcome is Decentralized KYC or DKYC. Someone with Web3JS & Web4JS with DKYC knowledge can implement this for your business.

It’s a Blockchain-powered KYC process free from the loopholes of the usual KYC process. In the DKYC process, KYC details upload once and can be used by many banks multiple times. Additionally, the push-pull model mechanizes the process.

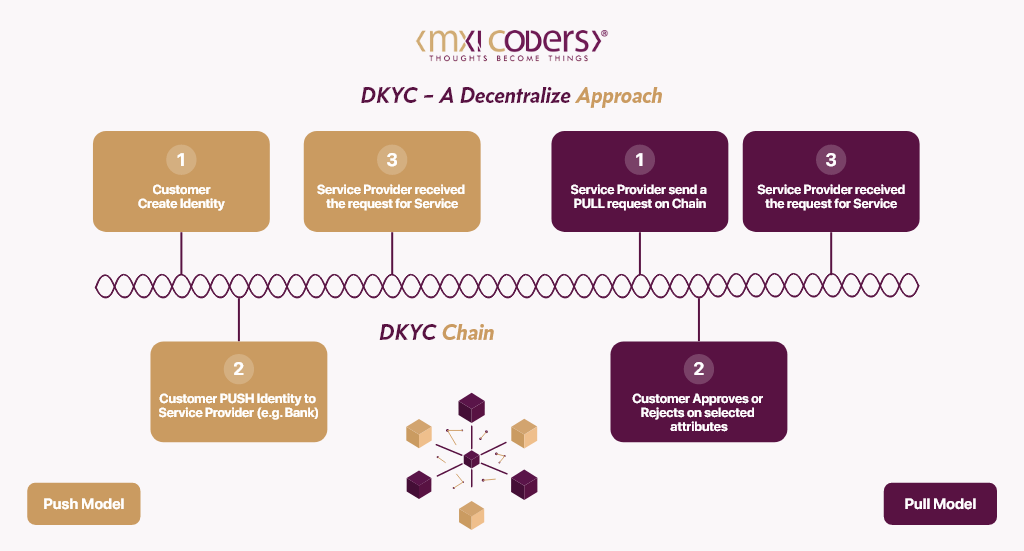

The entire model functions over a DKYC chain wherein the customers and banks link together. Let’s understand the working model of Decentralized KYC (DKYC) in detail.

The DKYC chain is built on Blockchain that is a distributed ledger allowing everyone, including over a single network, equal involvement opportunities. Usually, the chain builds using the help of a Blockchain development company.

Here, the involved parties are customers and banks. Both these entities use a public-private cryptographic key combination to interact with each other.

Using the DKYC chain, customers can upload their identity details and push the details to the banks. Banks receive the request, use the details as required. And then approve the use of banking services.

As the information once shared remains present till the eternity of the DKYC chain, other banks can also use the KYC details. In that case, the bank has to send the KYC pull d request on the chain. The customer receives the request, selects or rejects it, and the bank gets access details as per the customer’s decisions.

And The Revolution Has Begun…

Though DKYC is still in its infancy stage and has to cover a great distance to come into the mainstream, some the firms have made up their minds to bring this facility into full action. Polkadex is the first name to get mention here in this regard.

A notorious market player in the world of cryptocurrency, Polkadex is a non-custodial peer-to-peer trading platform offering the best of decentralized and decentralized exchanges.

Recently, the platform has partnered with KILT Protocol and Fractal to bring decentralized KYC into action. The platform wants to offer a better user experience and hold over user data.

Benefits of DKYC

Cutting down the repetitiveness of the outmoded KYC process is what made DKYC a winner instantly. But, on a deeper level, this modern KYC reaps unexpected benefits.

Below are some of the major benefits of Decentralized KYC –

Controlled Overheads

The storage space offered by Blockchain has no boundaries and demands fewer resources. Also, as the entire process automates, workforce needs fewer people. These factors reduce the KYC costs under control.

Improved Data Security

In the DKYC process, customers have full control over the identity details and have the freedom to keep the information utterly private. Any bank that wants to pull the identity details has to wait for end-users approval to fetch the details. Multiple authentication factors can be introduced by the end-users.

Quick Processing

In the DKYC, identity information will be uploaded once and used repeatedly without providing the same details repeatedly. Customers can use the details on multiple Web3 platforms by only verifying the account details.

Are You Ready For DKYC?

Decentralized exchanges and financial entities must start understanding the practical details of DKYC is must as this the future. Those who know the Blockchain basics will have no issue introducing DKYC into the ecosystem.

Blockchain novices or beginners must hire a Blockchain development company for the job. The key resources to complete the task areas are as below.

- Full Stack blockchain developers to build the DKYC chain.

- DKYC API integration to make the process a part of the decentralized change or in the banking process.

Take Away

We know that it’s too early to sing in praise with decentralized KYC, we still believe that DKYC is going to change the face of DeFI (Decentralized Finance) and Web3. The Polkadex move and its positive outcomes will encourage other market players to try their hand in this fairly new yet highly impressive domain.

With DKYC, banks are going to enjoy quick, cost-optimized, and seamless KYC processing while end-users get a supply with improved data security. Practically speaking, it’s a win-win situation for everyone.

Banking entities and decentralized exchanges must gear themselves for adopting this technology. As it could be too overwhelming for Blockchain rookies, taking the help of a skilled Blockchain development company seems a wise move.