Top 10+ DeFi Platforms You Should Watch Out for in 2024

Decentralized Finance (DeFi), has emerged as a growing trend in the financial sector, revolutionizing traditional finance process by leveraging the power of blockchain technology.

DeFi platforms operate on decentralized and transparent networks with secure and efficient ways of processing financial transactions for users.

In this article, we will explore the best DeFi platforms to consider in 2024, highlighting their unique features and benefits.

What is Decentralized Finance?

Decentralized Finance, commonly known as DeFi, is an innovative financial technology that’s rapidly transforming the way we manage and interact with money. Its core principle is simple yet revolutionary: to make financial services more accessible and efficient through the use of secure distributed ledger technologies.

But what exactly does this mean, and how does it work? Let’s delve deeper.

Decentralized Finance (DeFi) Explained

At its heart, DeFi is a new paradigm in the finance sector that leverages blockchain technology. It offers various financial services, such as lending and borrowing, without the need for traditional intermediaries like banks or insurance companies. This means financial transactions are managed solely by software running on blockchain networks, primarily Ethereum.

Unlike traditional financial systems where transactions are centrally controlled, DeFi platforms allow peer-to-peer transactions. This means you have control over your assets and can directly interact with the market.

DeFi offers several key advantages over traditional finance.

- For one, it’s accessible to anyone with an internet connection, making it a powerful tool for financial inclusion.

- Since there’s no need for intermediaries, DeFi services can be available 24/7, eliminating the need for paperwork and reducing transaction times.

- Moreover, DeFi allows users to lend or borrow funds from others, speculate on price movements using derivatives, and trade cryptocurrencies. This opens up a whole new world of financial opportunities that were previously unavailable to the average person.

In essence, DeFi is redefining the financial landscape by democratizing access to financial services and promoting financial autonomy. It’s a bold vision of banking and financial services centered around peer-to-peer payments and transactions.

Decentralized Finance is still in its early stages and, like any emerging technology, comes with its own challenges and risks.

However, its potential to disrupt traditional financial systems and empower individuals worldwide is undeniable.

The Growth of DeFi Market

The rise of DeFi represents a significant change in the financial industry, providing independence, ease of access, and cutting-edge financial solutions.

The Total Value Locked (TVL) in DeFi protocols has witnessed significant growth in recent years. In January 2020, TVL was under $1 billion, but by November 2021, it had surged to $248 billion, indicating a remarkable 350x rise in just 22 months.

While the market experienced a decline in 2022 during the crypto winter, the interest in DeFi remained strong, with TVL surpassing $50 billion in Q1 2023.

Experts predict that the DeFi market will continue to grow, with a projected market valuation of over $232.2 billion by 2032.

How to Get Involved with DeFi Platforms

There are several ways to get involved with DeFi platforms and take advantage of the innovative financial services they offer:

- Earning Yield: Deposit your crypto assets in DeFi platforms such as Aave or Compound to earn interest through Annual Percentage Yield (APY).

- Liquidity Mining: Provide liquidity to decentralized exchanges (DEXs) through liquidity pools and earn rewards in the platform’s native tokens.

- Trading on DEXs: Trade cryptocurrencies directly with other users on decentralized exchanges, which offer greater privacy and accessibility compared to centralized exchanges.

Getting involved in DeFi platforms requires careful consideration of factors like security, liquidity, user experience, interoperability, and community governance.

Prior to investing in any DeFi platform, it is crucial to carry out comprehensive research and due diligence. This approach helps mitigate risks, enabling investors to make well-informed decisions.

Top 12 Best DeFi Platforms

In 2024, the DeFi landscape is expected to be dynamic and competitive, with various platforms vying for user attention and adoption.

Here are the top 12 DeFi platforms to watch out:

1. Aave

Aave is known for its robust and efficient lending protocols, offering a seamless borrowing and lending experience on its Ethereum-based platform. It enables users to earn interest on their deposited assets while also allowing them to borrow funds secured by their collateral.

Aave is known for its robust and efficient lending protocols, offering a seamless borrowing and lending experience on its Ethereum-based platform. It enables users to earn interest on their deposited assets while also allowing them to borrow funds secured by their collateral.

Aave has gained popularity due to its diverse range of supported tokens and innovative features like flash loans. Despite the challenges in Ethereum’s scalability and transaction fees, Aave remains a prominent player in the DeFi space.

Key features:

- Lending and Borrowing: The primary service offered by Aave is a decentralized lending and borrowing platform. Users can lend their cryptocurrency assets in a liquidity pool and earn interest, or they can borrow against their crypto assets.

- Flash Loans: Aave introduced the concept of flash loans to the DeFi landscape. These are uncollateralized loans where borrowing and repayment occur within a single transaction block. If the borrower cannot repay the loan within the same block, the transaction fails, reducing the risk associated with lending.

- Rate Switching: Aave offers the option to switch between stable and variable interest rates. This unique feature allows users to take advantage of market conditions.

- Non-Custodial: Aave is a non-custodial platform, which means users maintain control over their assets at all times.

- Decentralized Governance: Aave operates under a decentralized governance model, where holders of the AAVE token have voting rights on protocol decisions.

- Safety Module: Aave has a built-in safety module to protect against unexpected losses. It allows stakeholders to stake their AAVE tokens as a sort of insurance against potential shortfalls.

- Integration of Loans and Credits: Aave provides a unique opportunity to integrate loans and credits in the field of cryptocurrencies.

2. Lido Finance

Lido Finance has emerged as a leading platform for liquid staking solutions. It allows users to stake their Ethereum and other Proof-of-Stake (PoS) chain tokens without locking their assets or maintaining staking infrastructure.

Lido Finance has emerged as a leading platform for liquid staking solutions. It allows users to stake their Ethereum and other Proof-of-Stake (PoS) chain tokens without locking their assets or maintaining staking infrastructure.

By providing liquid staking options, Lido Finance enables users to access the benefits of staking while maintaining flexibility and liquidity.

The platform has gained significant traction for its ability to generate passive income through staking rewards.

Key Features:

- Liquid Staking: At its core, Lido allows users to stake assets like Ethereum, Solana, Polygon, Polkadot, and Kusama while still having liquidity. This means you can stake your assets and still use them as collateral or in other DeFi protocols.

- Decentralized Autonomous Organization (DAO): Lido operates as a DAO, distributing governing rights through the protocol’s native crypto asset, LDO. This decentralized governance model gives stakeholders a say in the protocol’s decisions.

- Staking Rewards: Users who stake their assets with Lido earn staking rewards, providing an additional incentive for participation.

- Wide Range of Supported Assets: Lido supports a broad range of Proof-of-Stake-based cryptocurrencies, making it a versatile solution for those looking to stake different types of assets.

- Integration with Other DeFi Platforms: Lido’s staked assets can be employed as collateral on other DeFi platforms, increasing their utility and allowing users to maximize their returns.

- Large Total Value Locked (TVL): Lido has a significant amount of assets staked on its platform, showing trust from a large number of users.

3. Uniswap

Uniswap is a decentralized exchange (DEX) on the Ethereum network, enabling users to trade ERC20 tokens directly with each other. It operates on an automated market maker (AMM) model, utilizing liquidity pools and smart contracts to facilitate token swaps.

Uniswap is a decentralized exchange (DEX) on the Ethereum network, enabling users to trade ERC20 tokens directly with each other. It operates on an automated market maker (AMM) model, utilizing liquidity pools and smart contracts to facilitate token swaps.

Uniswap’s decentralized nature, efficient trading mechanisms, and permissionless architecture have made it a go-to platform for traders seeking secure and efficient transactions.

Key Features:

- Automated Liquidity Provision: Uniswap uses a unique model where liquidity is provided automatically. It allows anyone to deposit equal values of two tokens to create a liquidity pool, which others can trade against.

- Permissionless Trading: Uniswap operates on a permissionless model, meaning anyone can become a liquidity provider and earn fees from trades.

- Decentralized Exchange (DEX): Uniswap is a DEX where users can directly swap different cryptocurrencies without the need for an intermediary.

- Governance Token: Uniswap has its own governance token, UNI, which holders can use to vote on decisions about the platform’s future.

- High Degree of Composability: Uniswap integrates well with other DeFi applications, making it a cornerstone of the DeFi ecosystem.

- Privacy and Security: Uniswap places a strong emphasis on privacy and security, offering users control over their assets in a secure environment.

- ERC20 Pools: Uniswap v3 introduced the ability to create ERC20 pools, enhancing the platform’s utility and flexibility.

- Integration of Oracles: Uniswap v3 integrated oracles to ensure accurate pricing, further bolstering the platform’s reliability.

4. Ethereum

Despite facing scalability and transaction fee concerns, Ethereum remains a heavyweight contender in the DeFi space.

Despite facing scalability and transaction fee concerns, Ethereum remains a heavyweight contender in the DeFi space.

As the leading smart contract platform, Ethereum serves as the foundation for many DeFi applications and protocols.

Ethereum 2.0, its upcoming upgrade, aims to address these challenges through the implementation of a Proof-of-Stake (PoS) consensus mechanism, enhancing scalability and reducing transaction costs.

Ethereum’s network effect and established ecosystem position it as a key player in the DeFi market.

Check out if you want to be a validator on Ethereum.

Key Features:

- Permissionless: Ethereum’s DeFi platform is permissionless, which means anyone can participate without needing approval from a central authority.

- Programmability: One of Ethereum’s standout features is its programmability. Developers can build and deploy decentralized applications (dApps), including those for lending, borrowing, yield farming, and decentralized exchanges.

- Transparency: All transactions on the Ethereum network are transparent and can be audited, providing a high degree of accountability.

- Immutability: Once data is written to the Ethereum blockchain, it cannot be altered. This immutability builds trust among users.

- Interoperability: Ethereum’s DeFi platform supports a wide range of tokens and protocols, meaning different applications can interact seamlessly.

- Non-Custodial: Ethereum’s DeFi applications often give users control over their assets, rather than relying on a third party for custody.

- Smart Contracts: Ethereum introduced the concept of smart contracts, self-executing contracts with the terms directly written into code. This innovation is at the heart of many DeFi applications.

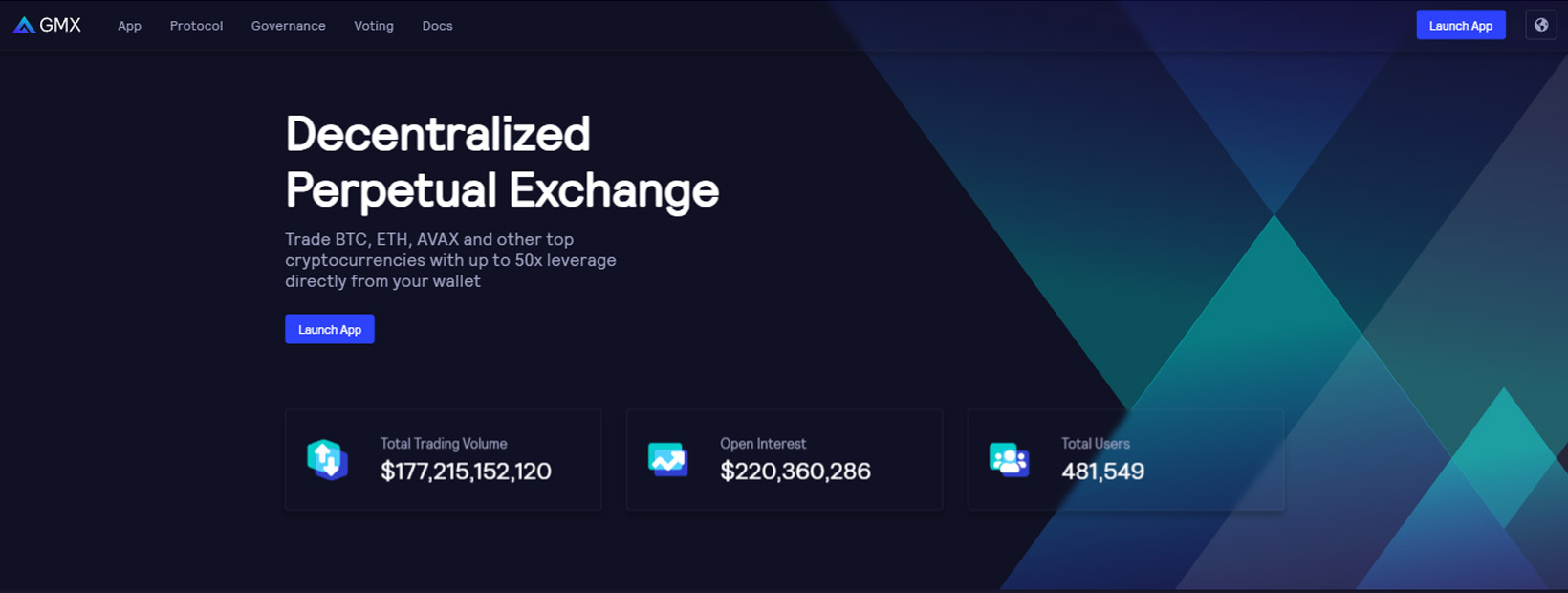

5. GMX

GMX, standing for Global Markets Exchange, is a decentralized exchange (DEX) that focuses on providing a reliable and efficient platform for trading cryptocurrencies.

GMX, standing for Global Markets Exchange, is a decentralized exchange (DEX) that focuses on providing a reliable and efficient platform for trading cryptocurrencies.

GMX stands out for its secure lending opportunities, seamless trading experience, and attractive staking rewards.

The platform offers users the ability to lend, borrow, and trade various cryptocurrencies, ensuring a high level of security and transparency.

With attractive staking rewards, GMX incentivizes users to participate in its ecosystem and contribute to its liquidity.

Key Features:

- Perpetual Trading: GMX allows users to trade cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Avalanche (AVAX) in the form of perpetual contracts, which have no expiry date.

- High Leverage: Users can trade with up to 50x leverage, enabling them to maximize their potential returns.

- Spot Trading: In addition to perpetual contracts, GMX also offers spot trading, where users can buy or sell cryptocurrencies directly.

- User-Friendly Interface: GMX features a comprehensive user interface that makes it easier for users to navigate and execute trades.

- Multi-Chain Functionality: GMX operates on multiple blockchains, including Arbitrum and Avalanche, providing more options for users.

- Oracle-Based Pricing: Prices on GMX are determined through oracle-based mechanisms, ensuring accurate and fair pricing.

- Low Swap Fees: GMX supports low swap fees, making it more cost-effective for users to trade.

- Staking Rewards and Transaction Discounts: GMX offers benefits such as transaction discounts and staking rewards, enhancing the platform’s overall utility.

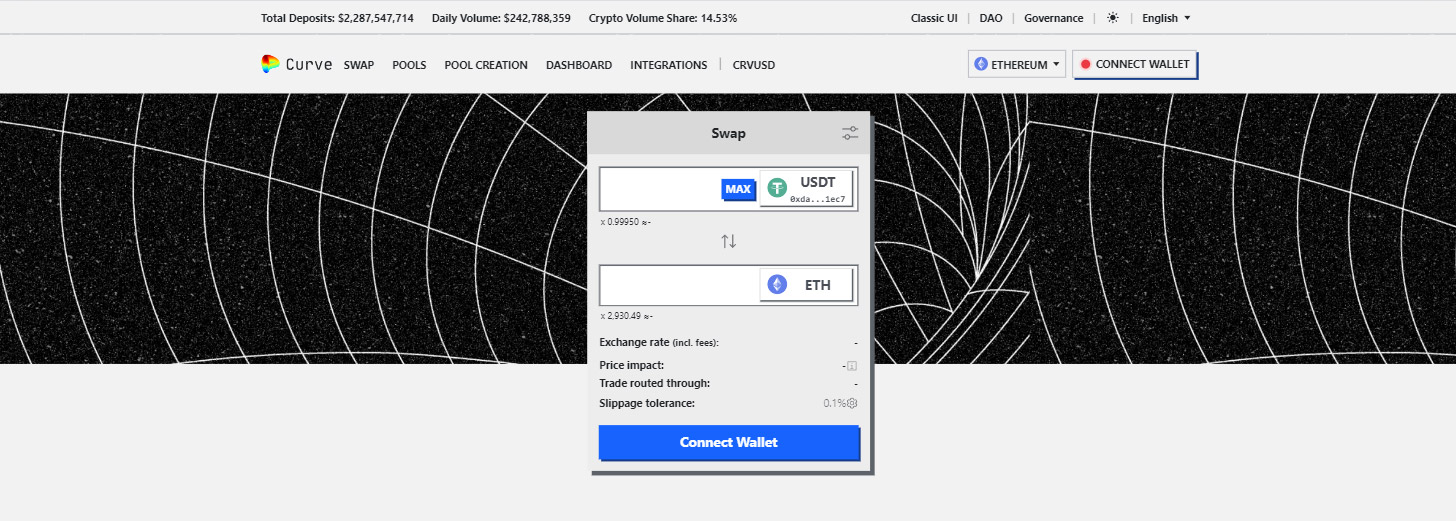

6. Curve Finance

Curve Finance is a prominent player in the decentralized finance (DeFi) space. As an automated market maker (AMM), it focuses on stablecoin trading offering minimal slippage and high liquidity pools.

Curve Finance is a prominent player in the decentralized finance (DeFi) space. As an automated market maker (AMM), it focuses on stablecoin trading offering minimal slippage and high liquidity pools.

As a decentralized exchange optimized for stablecoin trading, Curve Finance ensures efficient and secure transactions for users seeking to exchange stablecoins or earn yields through liquidity provision.

Its market-making algorithm and low fees make it a popular platform for stablecoin trading.

Key Features:

- Stablecoin Swaps: Curve Finance primarily facilitates the exchange of stablecoins, which are cryptocurrencies pegged to the value of a specific asset, usually a fiat currency.

- Low Slippage: Curve offers low slippage compared to other DeFi platforms, making it an attractive choice for large trades.

- Yield Farming and Liquidity Mining: Beyond basic trading functionality, Curve Finance offers yield farming and liquidity mining opportunities that can provide users with additional returns.

- High Efficiency: Curve’s unique AMM model allows it to offer highly efficient trades, especially for stable assets.

- CurveDAO: A crucial part of Curve’s infrastructure is the CurveDAO, a Decentralized Autonomous Organization that controls Curve Finance.

- Interoperability: Curve Finance operates on multiple blockchains, including Ethereum and Polygon, offering more options for users.

- CRV Token: Curve has its own native token, CRV, which users can earn through liquidity provision and use for governance votes.

7. Stargate Finance

Stargate Finance is a yield aggregator that maximizes returns for depositors by routing their assets to profitable strategies.

The platform utilizes an auto-compounding mechanism to continuously compound returns, maximizing compounding effects.

Stargate Finance is designed for users aiming to optimize their yield farming strategies and generate sustainable passive income.

Key Features:

- Native Asset Bridge: Stargate Finance is renowned for its native asset bridge, which allows seamless cross-chain transactions.

- Fast and Efficient Token Transfer: One of the major features of Stargate Finance is its ability to facilitate fast and efficient token transfers.

- Interoperability: Stargate Finance aims to bridge different blockchains, enabling efficient asset transfers across the decentralized ecosystem.

- Fully Customizable Liquidity Mechanism: Users and dApps can use Stargate to move native assets, making it a linchpin for Omnichain DeFi.

- Shared Pool Access: The platform supports shared access to a single pool across networks, which helps deepen the liquidity of the entire DeFi sector.

- Cross-Chain Transactions: Leveraging its innovative functionalities, Stargate simplifies cross-chain decentralized finance (DeFi) transactions, enabling almost instantaneous asset transfers.

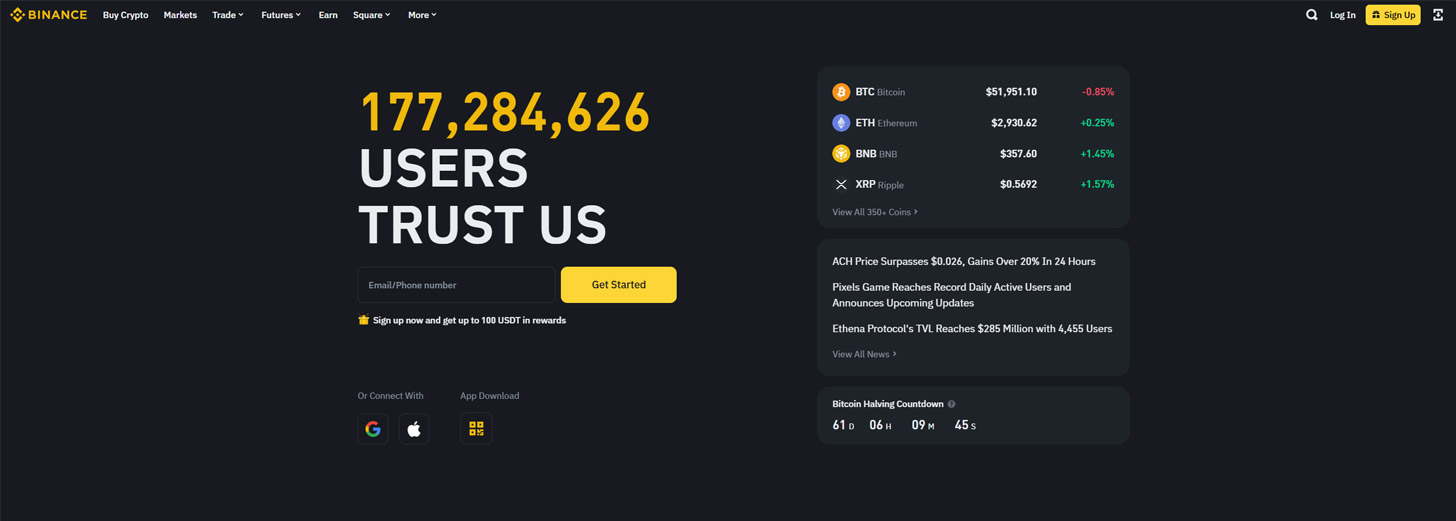

8. Binance

Binance, one of the world’s largest cryptocurrency exchanges, has expanded its services to include a decentralized finance (DeFi) platform with Binance Smart Chain and DeFi offerings. This allows users to participate in various financial activities directly on the blockchain.

Binance, one of the world’s largest cryptocurrency exchanges, has expanded its services to include a decentralized finance (DeFi) platform with Binance Smart Chain and DeFi offerings. This allows users to participate in various financial activities directly on the blockchain.

Binance Smart Chain provides a scalable and cost-effective environment for DeFi applications, attracting developers and users looking to leverage the benefits of decentralized finance. It offers various DeFi-related services, including lending, borrowing, trading, and staking, catering to a wide range of user needs.

Key Features:

- Monetary Banking Services: Binance DeFi platform supports the issuance of stablecoins.

- Automated Strategies: Binance Coin yield farming platforms use advanced algorithms, offering an innovative approach to maximizing returns.

- Ease of Use: Binance DeFi Staking is designed to be user-friendly, requiring no management of private keys, acquisition of resources, or complex tasks.

- Self-Hosted Wallets: These wallets offer more control over private keys and are crucial for using the DeFi platform.

- Decentralized Exchanges (DEXs): Binance DEX allows users to trade digital assets without needing a trusted intermediary.

- BNB as Collateral: Binance Coin (BNB) can be used as collateral on Binance’s lending platform.

- Binance Web3 Wallet: This feature allows users to explore the DeFi landscape with ease.

- Binance Smart Chain: It provides high transaction speed, low transaction cost, and cross-chain functionality.

9. Kraken

Kraken is a cryptocurrency exchange that bridges the gap between traditional and decentralized finance. It provides users with access to various DeFi protocols, allowing them to participate in lending, borrowing, staking, and other financial activities.

Kraken is a cryptocurrency exchange that bridges the gap between traditional and decentralized finance. It provides users with access to various DeFi protocols, allowing them to participate in lending, borrowing, staking, and other financial activities.

With its user-friendly interface, extensive range of services, and high security standards, Kraken appeals to both beginners and experienced users in the DeFi space.

Key Features:

- Cryptocurrency Trading: Kraken allows users to buy, sell, and trade leading cryptocurrencies shaping the DeFi landscape.

- Decentralized Lending and Borrowing: The platform enables users to lend their digital assets and earn interest, while others can borrow these assets.

- Deposit and Withdrawal Options: Users can deposit and withdraw both fiat and cryptocurrencies in Kraken.

- Security Measures: Kraken offers strong security protections, including two-factor authentication (2FA), email confirmations for withdrawals, and the option to whitelist withdrawal addresses.

- Low Fees: Kraken boasts low fees, making it an attractive option for traders.

- Wide Range of Supported Cryptocurrencies: Kraken supports over 200 cryptocurrencies, offering a wide range of trading pairs.

- User-Friendly Interface: The platform is designed to make trading and managing your portfolio intuitive and efficient.

- Staking Choices: It provides excellent staking choices, allowing users to create passive income.

- Regulatory Licenses: As a centralized platform, Kraken has regulatory licenses, providing users with added trust and security.

10. AQRU

AQRU is a new player in the DeFi staking landscape, offering competitive returns and a seamless staking experience.

AQRU is a new player in the DeFi staking landscape, offering competitive returns and a seamless staking experience.

The platform allows users to stake their digital assets and earn passive income through staking rewards.

AQRU’s focus on simplicity, security, and attractive yields positions it as an emerging DeFi platform to watch out in the coming years.

Key Features:

- Earning Interest: AQRU allows users to earn interest on their crypto portfolio, with rates of up to 10% APY.

- Yield Farming: The platform focuses on yield farming based on the largest and most liquid digital assets from established DeFi protocols.

- Lending and Borrowing: Users can maximize their earnings through AQRU’s comprehensive lending and borrowing guide.

- Advanced Order Types: AQRU provides access to advanced order types, further enhancing trading capabilities.

- Margin Trading: This feature allows users to leverage their positions for potential higher returns.

- Low Fees: AQRU is known for its low fees, making it a cost-effective option for users.

- Deposit via Fiat or Crypto: Users have the flexibility to deposit funds either via fiat currency or crypto, providing convenience and versatility.

- User-Friendly Platform: AQRU is designed with usability in mind, making it accessible for both beginners and experienced users.

- Secure Investment Platform: AQRU is recognized for its security, ensuring users’ investments are safe.

11. Crypto.com

Crypto.com offers a comprehensive staking platform for both beginners and seasoned stakers. With attractive Annual Percentage Yields (APYs) and a user-friendly interface, Crypto.com enables users to stake their cryptocurrencies and earn passive income.

Crypto.com offers a comprehensive staking platform for both beginners and seasoned stakers. With attractive Annual Percentage Yields (APYs) and a user-friendly interface, Crypto.com enables users to stake their cryptocurrencies and earn passive income.

The platform also provides additional features like cryptocurrency trading, debit card services, and a mobile app, catering to the diverse needs of crypto investors.

Check out this guide If you are facing issue while connecting your Defi wallet to Crypto.com.

Key Features:

- Non-Custodial Wallet: The Crypto.com DeFi Wallet is a non-custodial digital wallet, which means you have full control over your funds and private keys.

- Seamless Integration: Users can seamlessly connect their DeFi Wallet App to a desktop browser, making it convenient to send, receive crypto, view balances, and confirm DApp transactions.

- DeFi Earn: This feature demystifies decentralized finance and allows users to deposit their crypto assets to DeFi protocols through native in-app integration.

- Wide Range of Supported Tokens: The Crypto.com DeFi Wallet App offers over 20 tokens that can be staked or locked up easily.

- Secure Transactions: It offers a simple and secure way to explore DeFi projects.

- Deposit and Earn: Users can deposit and earn the best returns on their DeFi tokens.

- Swap Feature: The platform enables users to swap tokens directly within the wallet.

12. YouHodler

YouHodler is a crypto lending platform that allows users to earn high-interest rates on their crypto deposits. The platform also offers advanced trading facilities, including leveraged trading and a range of trading tools.

YouHodler is a crypto lending platform that allows users to earn high-interest rates on their crypto deposits. The platform also offers advanced trading facilities, including leveraged trading and a range of trading tools.

While YouHodler has faced transparency issues in the past, its attractive interest rates and robust trading features make it an interesting platform for users seeking to maximize returns on their crypto assets.

Key Features:

- Interest Accounts: With YouHodler, your funds can grow at a rate of up to 11.28% APY. It’s like having a garden where your money grows.

- Crypto & Fiat Fintech: The platform offers easy-to-use Web3 crypto and fiat fintech services for all users.

- Digital Asset Utilization: The platform’s wallet enables easy utilization of digital assets.

- Crypto Lending and Savings: YouHodler contributes to the growth of the DeFi ecosystem with their crypto lending and savings product.

- Instant Crypto Loan: The instant crypto loan is one of YouHodler’s tried and true features.

- Yield Farming: YouHodler FinTech platform focuses on crypto-backed lending with fiat (USD, EUR, CHF, GBP), crypto (BTC), and stablecoin loans (USDT, USDC).

- Multi-Faceted Architecture: Designed for buying, selling, trading, storing, and even lending.

In brief, these are some of the best DeFi platforms to watch out in 2024 and coming years.

When choosing a DeFi platform from such plenty of options, it is important to prioritize factors like security, liquidity, user experience, interoperability, and community governance. Yield rates, though enticing, should be considered alongside these factors.

Trust in the knowledge gained to confidently navigate the dynamic landscape of DeFi platforms and make informed investment choices.

Investment Insights and Considerations

As the DeFi market continues to grow and evolve, investors have the opportunity to participate in this innovative space.

Investing in DeFi platforms comes with its own set of opportunities and considerations.

Here are some investment insights and factors to consider when evaluating DeFi platforms:

- Security: Security is paramount in the DeFi space. Before investing, it is essential to assess the platform’s security measures, including auditing processes, smart contract security, and risk management protocols. Platforms with robust security measures protect investors’ funds and minimize the risk of hacking or vulnerabilities.

- Liquidity: Liquidity is crucial for a thriving DeFi ecosystem. Platforms with high liquidity ensure that users can easily enter and exit positions, trade assets, or participate in yield farming. High liquidity also offers better price discovery and reduced slippage.

- User Experience: User experience plays a significant role in attracting and retaining users. Platforms with intuitive interfaces, seamless onboarding processes, and user-friendly features provide a superior user experience. An intuitive user interface simplifies complex processes and ensures a smooth experience for both beginners and experienced users.

- Interoperability: Interoperability enables the seamless transfer of assets and data across different blockchain networks. Platforms that support interoperability allow users to access multiple DeFi protocols, trade different cryptocurrencies, and harness the advantages of various blockchain ecosystems.

- Community Governance: Community governance is a key aspect of decentralized platforms. Platforms that involve their community in decision-making processes and allow token holders to participate in governance decisions offer transparency and decentralization. Community participation fosters a sense of ownership and ensures platforms continue to evolve and meet the needs of their users.

When evaluating DeFi platforms, it is essential to conduct thorough research, read reviews, and consider factors discussed above. It is also advisable to start with smaller investments and diversify across multiple platforms to mitigate potential risks.

By taking a cautious approach and staying informed, investors can navigate the DeFi landscape and make informed investment decisions.

FAQs about DeFi Platforms

What Defines the Best DeFi Platforms?

The best DeFi platforms are determined by their unique features, security measures, liquidity, user experience, interoperability, and community governance. These platforms prioritize user needs, offer innovative financial services, and have demonstrated credibility and reliability within the DeFi ecosystem.

What are the Best DeFi Platforms for Trading?

The top DeFi platforms for trading include Uniswap, Aave, SushiSwap, PancakeSwap, MakerDAO, Compound, Yearn.Finance, Synthetix, Curve Finance, and Balancer. These platforms offer various features like decentralized exchanges, lending systems, market makers, and creation of on-chain synthetic assets.

What are the Recommended DeFi Platforms for Staking?

For staking, AQRU, Binance, CAKE DEFI, Crypto.com, Defi Swap, Nebeus, Nexo, OKX, Lido, Ethereum 2.0, and Uniswap are some of the best DeFi platforms to consider. Other notable mentions are Polka Dots, Cardano, Rocket Pool, Bake, Stake DAO, and StakeWise.

What are the Best DeFi Platforms to Earn Interest?

The top DeFi platforms to earn interest include Aave, Coinbase, Cream, Nebeus, Crypto.com, Coinrabbit, and JustLend DAO. Other notable platforms are MakerDAO, 88mph, Abracadabra, Alchemix, BENQI, Compound, Euler, and Kamino Finance.

What are the Top DeFi Platforms for Beginners?

The best DeFi platforms for beginners include Uniswap, Aave, MakerDAO, Compound, and Yearn Finance. Other beginner-friendly platforms are eToro, for its simple trading interface, and SushiSwap.

Conclusion

In brief, the world of decentralized finance is rapidly evolving, offering autonomy, accessibility, and innovative financial services. The top DeFi platforms are expected to play significant roles in the DeFi space in 2024, providing users with diverse functionalities, secure infrastructure, and attractive yields.

With continuous innovation and the addition of new protocols, the DeFi space remains one of the most exciting areas to watch in the financial industry.